Anyone expecting smooth sailing ahead for the housing market got a reality check in February. Month-to-month drops in home resales in several of Canada’s major markets were a reminder that very challenging affordability conditions still heavily constrain many buyers—despite emerging signs of a market turnaround in the previous two months. Reports from local real estate boards showed February’s backsteps partly reversed advances made at seasonal low points in December and January.

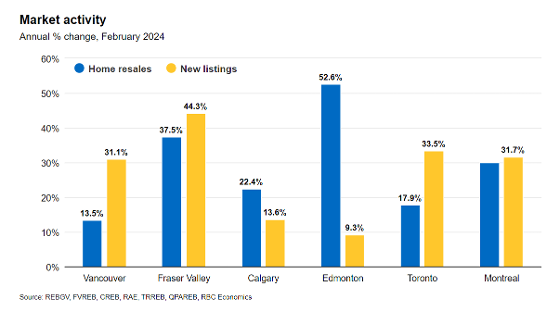

Some of these reports also revealed a rise in sellers entering the market. This was the case in Vancouver, the Fraser Valley, Edmonton, Hamilton and Montreal, where we estimate new listings increased between 3% and 14% from January. We suspect sellers who took a pass in the fall may have taken an early jump on the upcoming spring market, warmed by news of busier activity in December and January. Demand-supply conditions generally eased across the country last month though remained balanced in most of Canada, with several Prairies markets still strongly favouring sellers.

And yet, home prices picked up (slightly) in all major markets—perhaps marking a turning point. The MLS Home Price Index in Toronto, for instance, rose month over month for the first time in seven months. The earlier tightening in demand-supply conditions in December and January no doubt gave sellers more sway in setting prices. We think a vigorous, sustained recovery won’t take shape until interest rates fall more meaningfully—something we peg for the second half of 2024.

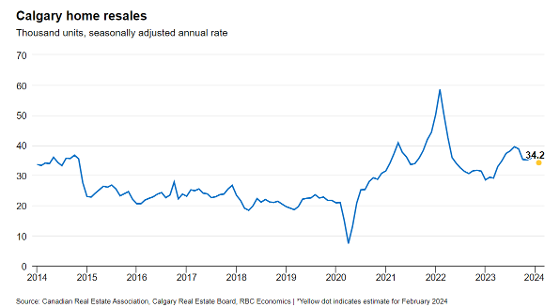

Calgary — Still solid despite some volatility

The Calgary market is easily the busiest—and hottest—in the country but its pace slowed down in February. We estimate home resales fell 8% m/m, reversing the prior two months’ gains. We don’t think the development signals anything other than normal month-to-month volatility. Resales still stand more than 60% above pre-pandemic levels. Housing demand remains exceptionally strong in the area, fueled by tremendous population growth. The sharp loss of affordability during the pandemic no doubt pinches many potential buyers though with demand-supply conditions so tight, many more are clearly in the game. Calgary prices are up the most over the past year among the markets we track. The rise in the MLS HPI clocked in 10.3% y/y February, little changed from the prior three months. We expect this stable trend to persist in the near term.

Courtesy RBC